New 1099 Rules 2024 Form – Millions of taxpayers who generate income via online platforms may be receiving Form 1099-K for the first time. . The IRS wants to crack down on third-party payment reporting and was initially planning to require these platforms to issue a 1099 form 2024, the IRS is only going to phase in the new .

New 1099 Rules 2024 Form

Source : markjkohler.comIRS Delays Implementation of 1099 K Filing Changes to Calendar

Source : taxschool.illinois.eduHow Did Your 1099 Season Go? New E Filing Rules Challenged Some in

Source : www.cpapracticeadvisor.comIRS Delays 2023 Form 1099 K Threshold, Introduces $5,000 for 2024

Source : www.drakesoftware.com1099 Rules Business Owners Should Know in 2024

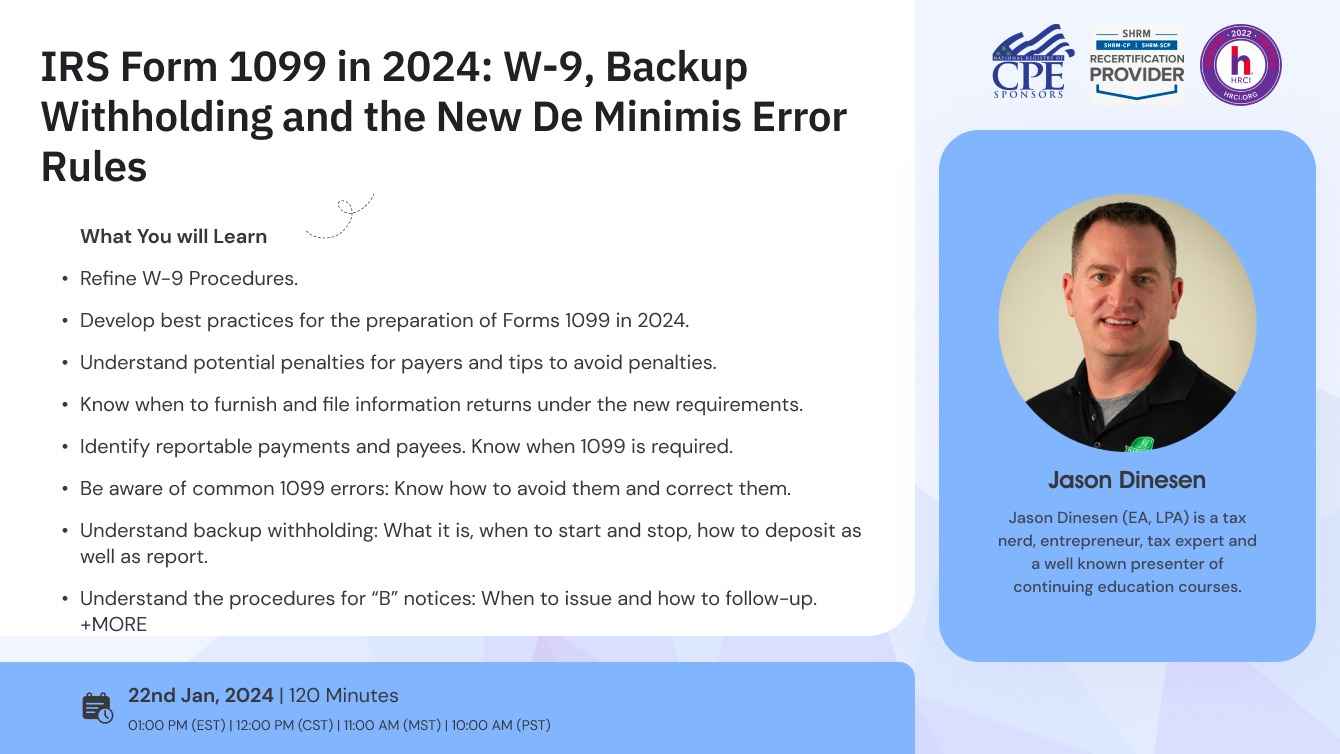

Source : tipalti.comIRS Form 1099 in 2024: W 9, Backup Withholding and the New De

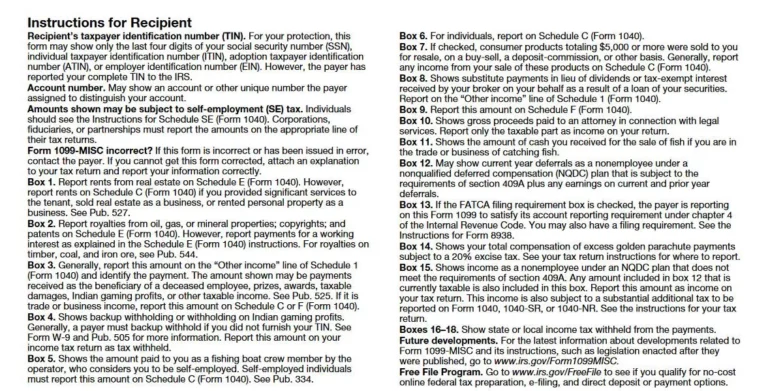

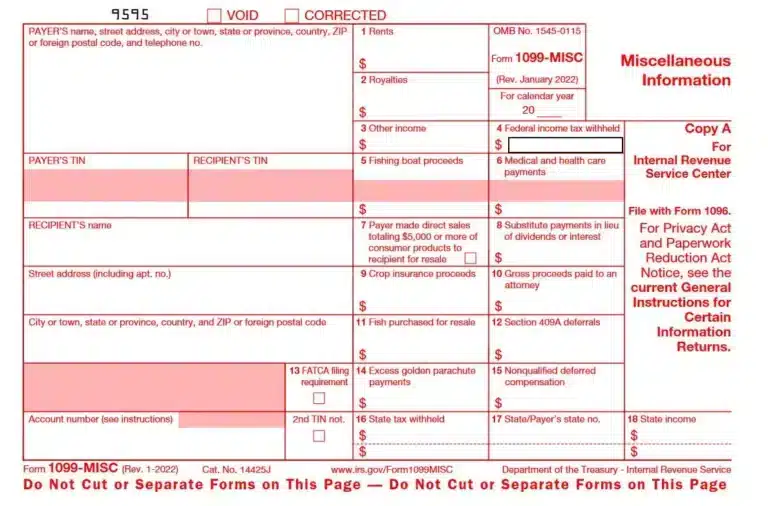

Source : clatid.ioForm 1099 MISC Explained: Instructions and Uses

Source : tipalti.comIRS Delays Implementation of $600 Reporting Threshold in Form 1099

Source : www.linkedin.comIRS Announces Another Delay in Form 1099 K Reporting | Optima Tax

Source : optimataxrelief.comE File Form 1099 NEC Online in 2024! BoomTax

Source : boomtax.comNew 1099 Rules 2024 Form 1099 Rules for Business Owners in 2024 Mark J. Kohler: Ready or not, the 2024 tax filing season is here. As of January 29, the IRS is accepting and processing tax returns for 2023. The agency expects more than 128 million returns to be filed before the . If the interest is credited at maturity, you will receive a tax form for 2024 — not for 2023, said Ken Tumin, founder of DepositAccounts.com, a site to compare yields on CDs, savings accounts and .

]]>